Revenue cycle management (RCM) is a broad term capturing the submission, collection, and working of healthcare claims from provider organizations to insurance providers. RCM encompasses tools, processes, and services that together form the backbone of our healthcare financial system and, in an ideal state, effectively ensures provider organizations receive timely and accurate payment for the services they deliver. RCM sits across the entire patient journey, from scheduling the first appointment when an eligibility check is performed to ensure adequate insurance coverage, through to processing the final payment when funds hit the provider’s bank account.

For a provider organization, effective revenue cycle management is essential to the viability of the business and therefore, patient access to care. Yet RCM remains one of healthcare's most complex operational challenges. Claims are routinely denied for minor administrative errors, such as a missing modifier, an incorrect rendering provider NPI, or a mismatched eligibility date. Each time this happens, identifying the cause of the denial and remedying the issue requires manual research and resubmission. Provider organizations navigate a labyrinth of payer-specific requirements, with each insurance company maintaining its own rules for prior authorization, documentation, and billing codes. The average medical practice dedicates substantial staff resources to denial management alone, often waiting 30-120 days for claim resolution while managing their own cash flow needs. Meanwhile, clinical staff find themselves pulled away from patient care to document encounters in ways that satisfy billing requirements rather than optimize care delivery. The result is a system where administrative costs consume an estimated 15-25% of total healthcare spending, clean claim rates hover around 75-80% industry-wide, and provider organizations struggle with the fundamental tension between running a sustainable business and focusing on patient care.

But there is hope. Modern EMR systems are embedding intelligent automation directly into clinical workflows, flagging missing documentation before claims are submitted, auto-populating procedure codes based on encounter notes, and routing claims with the correct modifiers for each payer's requirements. AI agents are now handling tasks that previously consumed hours of staff time: automatically scrubbing claims for common errors, researching denial reasons and drafting appeals with supporting documentation, monitoring eligibility changes in real-time, and even predicting which claims are likely to be denied before submission.

Beyond technology, proven operational excellence does exist across the industry. High-performing billing operations achieve 95%+ clean claim rates, the industry benchmark for excellence, through rigorous front-end eligibility verification and standardized clinical documentation templates that align with billing requirements. Advanced RCM service providers demonstrate that combining automation with expertise can push performance even higher, achieving 98% clean claim rates while accelerating payment cycles and reducing administrative burdens. Leading health systems structure their accounts receivable teams to specialize by payer, developing deep expertise in each insurer's specific requirements and maintaining relationships with payer representatives who can expedite complex claims. These organizations prove that the combination of smart automation, process discipline, and human expertise can transform RCM from a resource drain into a competitive advantage.

Understanding the Healthcare Revenue Cycle

The healthcare revenue cycle covers the entire financial journey, from patient scheduling to treatment, billing, and final payment. Each stage ensures that services are accurately documented, billed, and reimbursed, thereby maintaining the financial health of organizations.

Due to the presence of multiple insurance plans, regulations, and payment rules, today’s revenue cycle is more complex than ever. Strong systems are crucial for minimizing errors, maintaining a steady cash flow, and safeguarding both providers and patients from costly delays.

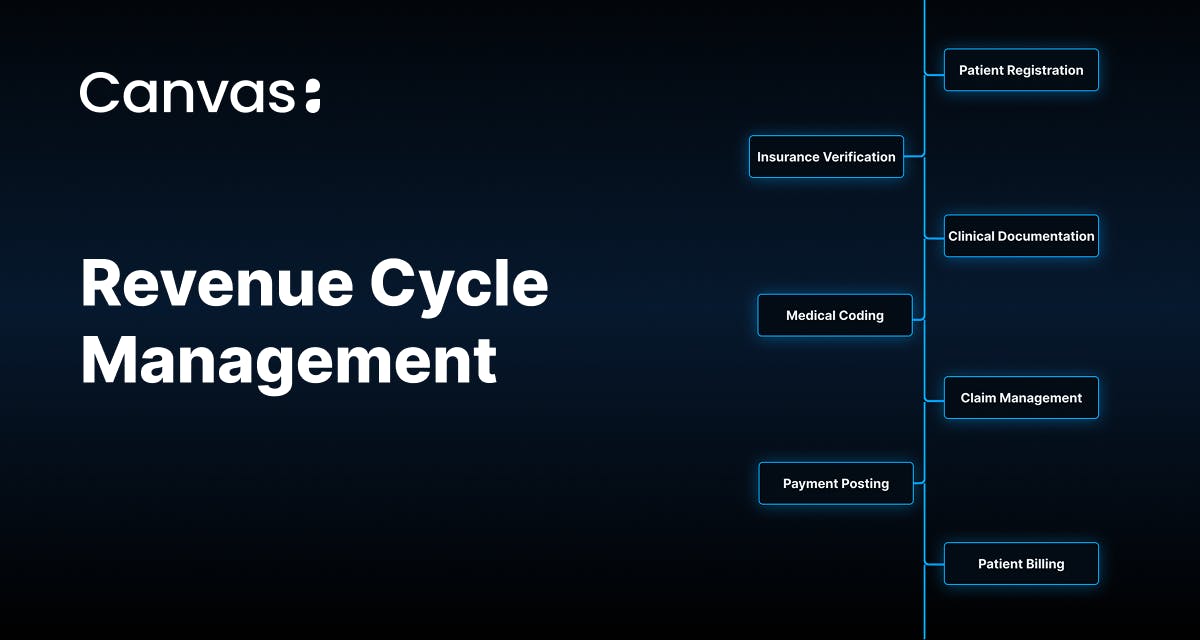

Key Steps in the Revenue Cycle Management Process

The revenue cycle management process ensures that healthcare providers receive accurate payment for their services, moving seamlessly from the initial patient interaction to final payment. Understanding each step helps reduce revenue loss and strengthen financial performance.

Modern RCM processes rely on technology and automation to streamline billing, cut errors, and improve accuracy. By breaking the cycle into distinct stages, providers can identify bottlenecks and implement solutions that lead to improved outcomes.

Patient Registration and Scheduling

Patient registration marks the beginning of the revenue cycle and sets the tone for everything that follows. Staff collect demographic details, insurance information, and contact data, and accurate entry at this stage prevents costly errors later in the billing process.

Registration has largely shifted from paper forms to digital tools, such as patient portals and mobile apps, which enable patients to complete their information before arriving. This gives staff more time to verify accuracy and correct issues before they occur.

Insurance Verification and Patient Eligibility

Insurance verification is one of the most important steps in preventing revenue loss. Providers must confirm that patients have active coverage, verify policy status and dates, and check deductibles, copayments, and prior authorization requirements to ensure accurate billing.

Identifying gaps early helps avoid denials and unexpected costs for patients. With real-time eligibility systems, providers receive instant confirmation, rather than waiting hours or days, which reduces unpaid claims and provides patients with clarity about their financial obligations before treatment begins.

Charge Capture and Clinical Documentation

Charge capture ensures that all services delivered to the patient are documented and billed. Any missed charges directly translate into lost revenue. Strong clinical documentation supports this process by including all treatments, procedures, and services while also justifying medical necessity for payers.

Modern EHRs play a key role by automatically capturing charges as providers document services. When integrated with billing systems, this automation helps reduce errors and ensures all revenue opportunities are captured.

Medical Coding and Accurate Billing

Medical coding translates the details of clinical documentation into standardized codes that insurance companies use to process claims accurately and efficiently. Coders assign diagnosis, procedure, and supply codes that must accurately reflect services provided and comply with payer requirements. Errors at this stage often lead to denials, delays, or compliance risks.

Submitting Claims and Claim Management

Submitting claims is the formal request for payment sent to insurers. Accuracy and compliance are critical at this stage, so claims are carefully reviewed or “scrubbed” before submission to catch errors and missing information.

Electronic submission speeds up processing and provides real-time feedback, reducing delays. Claim management continues after submission, requiring providers to track status, respond to payer requests, and appeal denials quickly to avoid lost revenue.

Payment Posting and Reconciliation

Payment posting records all payments received from insurers and patients, ensuring that accounts receivable remain accurate. Each payment must be matched to its claim, with adjustments, denials, or underpayments flagged for review.

Reconciliation ensures actual payments align with expected reimbursements, allowing providers to identify discrepancies quickly. Electronic remittance advice (ERA) has simplified this process, enabling automated posting and reducing manual data entry while freeing staff to focus on exceptions.

Patient Billing and Collections

The final step in the revenue cycle involves billing patients for any remaining balances after insurance payments. With high-deductible health plans becoming more common, this phase has grown increasingly important. Clear communication of financial responsibilities upfront, combined with easy-to-read statements, helps reduce confusion.

Offering flexible payment options or installment plans improves collection rates. Successful collections strike a balance between financial recovery and patient trust—organizations that adopt a patient-friendly approach often achieve better results than those employing aggressive tactics.

Common Challenges in Healthcare Revenue Cycle Management

Healthcare organizations face many revenue cycle challenges that can disrupt cash flow, raise costs, and strain patient relationships. With constantly changing regulations, payer rules, and patient expectations, providers must remain agile to maintain efficient and financially healthy operations.

Billing Errors and Coding Problems

Billing and coding mistakes are a major source of revenue loss in healthcare. Errors, such as incorrect procedure codes, missing modifiers, or mislinked diagnoses, often originate from incomplete information at the time of registration or documentation.

These issues lead to delays, denials, and even audits that strain payer relationships. Contributing factors include inadequate coder training, rushed documentation, and limited system safeguards.

Claim Denials and Delayed Payments

Denials are among the most costly challenges in RCM, often caused by missing documentation, incorrect coding, or repeated errors. Each denial adds administrative burden through appeals and slows cash flow. Even approved claims may face delayed payments, straining finances and delaying investments in patient care.

To reduce denials, providers should track denial reasons, address the root causes, and utilize automated systems to monitor claim status in real-time.

Maintaining Compliance and Protecting Patient Data

In revenue cycle management, compliance and data security are critical. Violations can result in fines, legal issues, and a loss of patient trust. Providers must comply with HIPAA and state-specific regulations, adapt to frequent payer changes, and protect against cyber threats and unauthorized access to ensure patient privacy and security.

Best practices include enforcing HIPAA-compliant workflows, regularly training staff, and utilizing robust cybersecurity tools with clear response plans in place.

Research highlights that revenue cycle challenges often stem from documentation gaps and inefficient processes, reinforcing the need for continuous improvement and automation

Best Practices for Improving RCM Outcomes

Technology has reshaped revenue cycle management by replacing manual tasks with automated workflows that boost accuracy and efficiency.

Modern RCM tools utilize AI, machine learning, and cloud systems to minimize errors, expedite billing, and provide insights that enhance financial performance from registration to final payment.

Electronic Health Records and Automation

EHRs are the backbone of modern RCM, linking clinical and financial data to reduce manual entry and billing errors. Automation enhances this connection with tools like real-time eligibility checks, prior authorization management, and automated charge capture.

Using RCM Software and Data Analytics

RCM platforms extend beyond billing to provide analytics that inform smarter decisions. By aggregating data across systems, they provide predictive models for cash flow, highlight at-risk accounts, and optimize collections.

Real-time dashboards make KPIs visible instantly, enabling leaders to act quickly and improve both efficiency and financial outcomes.

Optimizing revenue cycle management (RCM) strengthens financial health by accelerating cash flow, reducing costs, and improving overall performance. These gains allow providers to reinvest in patient care and growth. Strong RCM also leads to lower collection costs, faster payments, and higher net collection rates.

Measure Cash Flow and Financial Stability

Consistent cash flow ensures that operations run smoothly and fund future improvements. Effective RCM shortens the gap between services rendered and payments received by reducing claim denials, submitting claims promptly, and improving patient collections through clear communication and flexible options.

To measure and improve RCM performance, organizations should track key metrics that reveal both efficiency and financial health. Days in Accounts Receivable (target: 30-40 days) shows how quickly payment is collected after service delivery. Clean Claim Rate (benchmark: 95%+) indicates the percentage of claims accepted on first submission without errors. Denial Rate and the percentage of A/R over 90 days highlight where revenue is leaking or getting stuck. Net Collection Rate measures actual payments against expected reimbursement, revealing how much potential revenue is being left on the table. Together, these KPIs provide early warning signals when processes break down, allowing organizations to course-correct before cash flow problems emerge. High-performing organizations review these metrics monthly, drilling into specific payers or service lines to identify systematic issues rather than just treating symptoms.

Focus on Lost Revenue and Outstanding Receivables

Missed charges, coding errors, and write-offs drain revenue. Strong documentation and billing practices ensure complete revenue capture, while active accounts receivable management prevents excessive payment delays.

Denial management (tracking root causes and addressing process gaps) further reduces losses. By lowering A/R days, organizations free up resources for patient services and ongoing operational needs.

Implementing best practices in revenue cycle management (RCM) requires a comprehensive approach that blends people, processes, and technology. High-performing organizations recognize that excellence in RCM comes from continuous improvement and adapting to evolving regulations, payer demands, and patient expectations.

While every healthcare organization may tailor strategies to its unique culture and goals, several core principles apply across all settings.

Ensure Accurate Patient Data Collection

Accurate patient data on registration forms the bedrock of a successful revenue cycle. Errors here ripple throughout the process, leading to claim denials, delayed payments, and frustrated patients. Best practices include:

- Collecting complete and correct demographic and insurance details during the first patient interaction.

- Training front-line staff on the importance of precision and how small mistakes impact billing, collections, and patient satisfaction.

- Using technology for data validation, duplicate checking, and real-time insurance verification to flag coverage issues before they turn into revenue problems.

Provide Clear Communication and Staff Training

Smooth RCM requires strong communication between clinical, billing, and administrative teams, as well as clear communication with patients. Best practices include:

- Helping clinical staff understand how documentation influences billing accuracy.

- Ensuring billing teams stay informed about clinical workflows and payer-specific requirements.

- Offering regular training programs to keep staff up to date with evolving rules, technologies, and internal procedures.

- Providing patient-facing staff with communication skills to explain insurance benefits, financial responsibilities, and payment options clearly and empathetically.

Track Key Performance Indicators

What gets measured gets managed. Monitoring the right KPIs provides insight into revenue cycle health and highlights areas for improvement. Common KPIs include:

- Days in accounts receivable (A/R): Tracks how long it takes to collect payments.

- First-pass claim acceptance rate: Measures the percentage of claims paid on first submission.

- Denial rate: Identifies the percentage of claims rejected by payers.

- Net collection percentage: Shows how effectively an organization collects the revenue it’s entitled to.

Advanced analytics can take this further by forecasting cash flow with predictive models and recommending corrective actions through prescriptive analytics. These insights provide leaders with the tools to improve performance proactively, rather than reactively.

Improve the Patient Experience

A strong revenue cycle creates positive touchpoints throughout the entire process, from registration to final payment. Streamlined digital tools simplify the intake process, while upfront cost estimates and clear insurance explanations build trust.

Financial counseling helps patients understand their options, and self-service tools, such as online payments and account access, add convenience. Together, these practices make billing less stressful and strengthen patient-provider relationships.

Ensure Patient Satisfaction and Transparency

Transparent billing is essential. Patients expect clear communication about costs, coverage, and payment plans in plain language.

Proactive outreach before bills arrive prevents surprises, and patient-centered collections with flexible payment options build goodwill. Even when expenses are high, respectful financial processes create trust and improve satisfaction.

How Canvas Medical Streamlines Revenue Cycle Management

Canvas Medical unifies clinical care and financial operations in one programmable EMR platform. By automating revenue cycle workflows inside the care process instead of relying on separate billing tools, Canvas helps reduce manual entry, denials, and payment delays.

Built on a certified EMR foundation with FHIR-native interoperability, HITRUST certification, and a programmable SDK, Canvas gives healthcare teams clear visibility and control over the entire revenue cycle, from patient intake to reimbursement.

Key Ways Canvas Supports RCM

Automated Charge Capture and Coding

Canvas automatically maps clinical documentation to billing codes. With Narrative Charting and Canvas Hyperscribe, clinicians can document naturally while the system captures structured data in real time for coding and billing. This reduces missed charges and rework.

Seamless Data Flow with FHIR Integration

Through FHIR APIs and SMART-on-FHIR, Canvas connects payer, clinical, and billing systems so eligibility checks, authorizations, and claim submissions move smoothly across platforms.

Automated Workflows and Protocols

With RCM specific Extensions, organizations can trigger billing tasks, assign eligibility reviews, or reopen denied claims automatically. This keeps the process efficient and consistent.

AI-Powered Documentation Review

Canvas includes built-in AI tools that detect missing fields or incomplete documentation before submission. This improves first-pass approvals and speeds up payments.

Unified Data and Secure Compliance

The Canvas Deep Unified Architecture™ integrates clinical, financial, and administrative data in one system. All transactions are encrypted, logged, and protected under HITRUST certification for HIPAA compliance.

With Canvas, revenue cycle management becomes a complete, closed-loop process where documentation, coding, and billing align seamlessly. Claims are cleaner, payments are faster, and teams spend less time resolving denials. By making RCM programmable and data-driven, Canvas helps healthcare organizations strengthen financial performance while improving the patient experience.

Optimizing the Revenue Cycle for Long-Term Success

Revenue cycle management in healthcare is more than an administrative task—it’s a strategic function that supports financial health and better patient care. By streamlining processes, reducing errors, and embracing modern technology, providers can enhance cash flow, minimize revenue loss, and foster greater patient trust.

The future of RCM lies in automation, predictive analytics, and AI-driven tools that make billing and collections more intelligent and efficient. Healthcare organizations that invest in flexible, scalable systems today will be ready to meet tomorrow’s challenges with confidence.

Frequently Asked Questions (FAQs)

What is healthcare revenue cycle management?

Healthcare revenue cycle management (RCM) is the process of handling all financial interactions between patients and providers—from the initial appointment through final payment—to ensure services are billed and reimbursed accurately and on time.

What are the 7 steps of RCM?

The seven steps of RCM are: patient registration, insurance verification, medical coding, claims submission, claims adjudication, payment posting, and denial management.

What are the 6 stages of the revenue cycle in healthcare?

The six stages include pre-registration, registration, eligibility verification, charge capture, claim submission, and payment posting.

What are the three pillars of RCM?

The three pillars—people, processes, and technology—work together to ensure financial stability and efficiency in healthcare organizations.